The cITMre library—Colombian Index Tool (Market Rate Exchange)—responds to the researcher’s economics and financial sciences needs to use the colombian Representative Market Rate Exchange. This package presents a practical solution for downloading the RMRE database.

The tool allows us to obtain:

- Download the data series in daily, monthly, quarterly, and half-yearly frequencies.

- Can split the time series through start and end function

- Can transform the data set in log returns or level

- Can make a Dynamic graph through Plotly, or if is your preference can make a normal plot.

Motivation

Obtaining information from the Colombian RMRE is relatively straightforward; the search in the official state database Portal de Datos Abiertos <www.datos.gov.co> allows the data to be downloaded in .xls or .csv. In economics or financial sciences, obtaining and loading this information into R can be frustrating, forcing many users to create a routine function linked to the database limited to the user’s expertise. Thus, this tool aims to facilitate both the loading of data and the use of essential RMRE time series analysis tools.

Note: The information discounts weekends and holidays; the function approximates the nearest trade date.

Applied Example

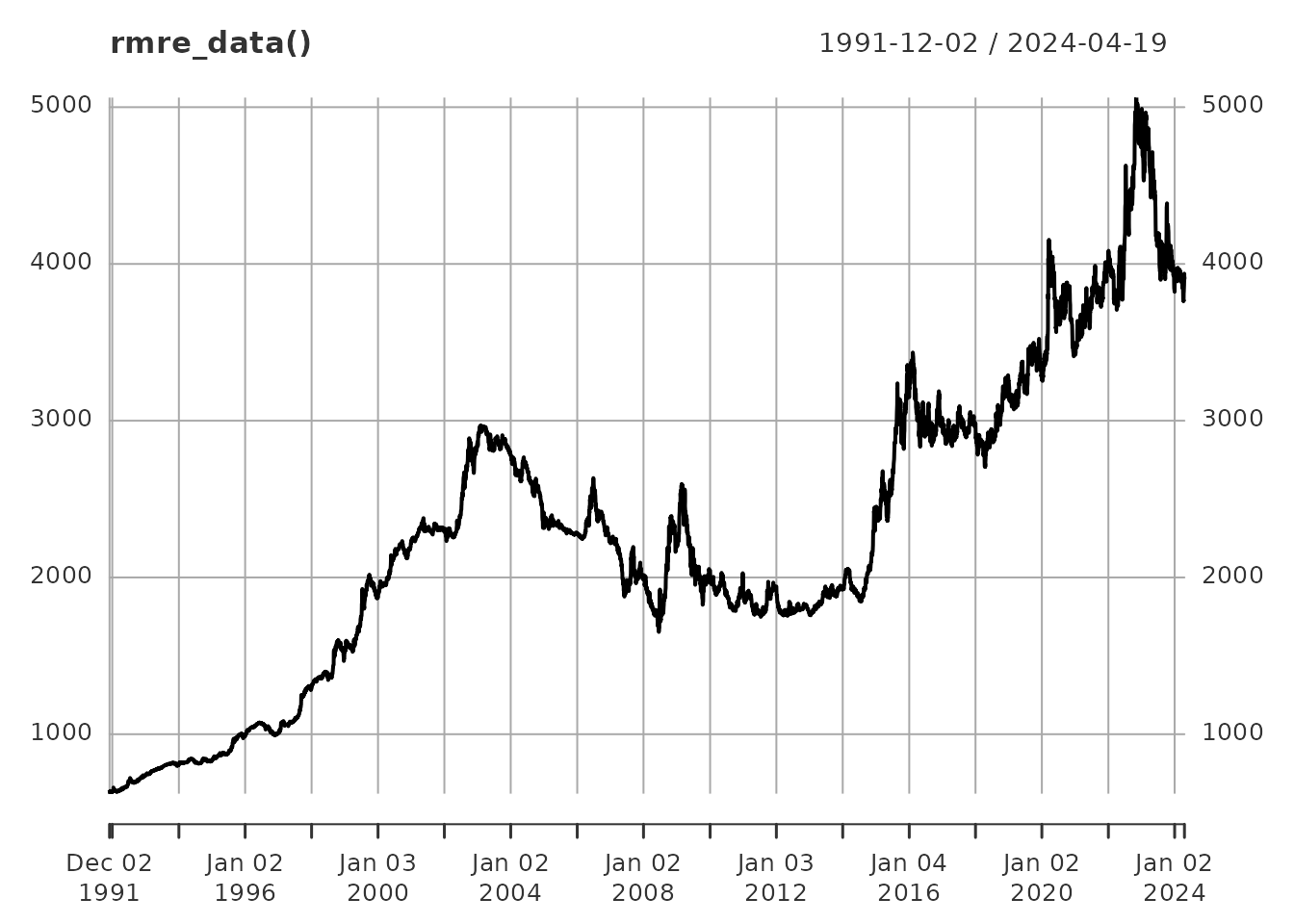

If you want to use citmre, perform the package

installation process using install.package("citmre") or

through CRAN and load the library(citmre) library. Once the

package is installed, use the rmre_data() function to

obtain the total RMRE series (the Colombian state has RMRE data since

1991-12-02); the data loaded is an XTS series. This information can be

plotted through plot().

library(citmre)

head(rmre_data())

#> rmre

#> 1991-12-02 643.42

#> 1991-12-03 639.22

#> 1991-12-04 635.70

#> 1991-12-05 631.51

#> 1991-12-06 627.16

#> 1991-12-09 638.06

plot(rmre_data())

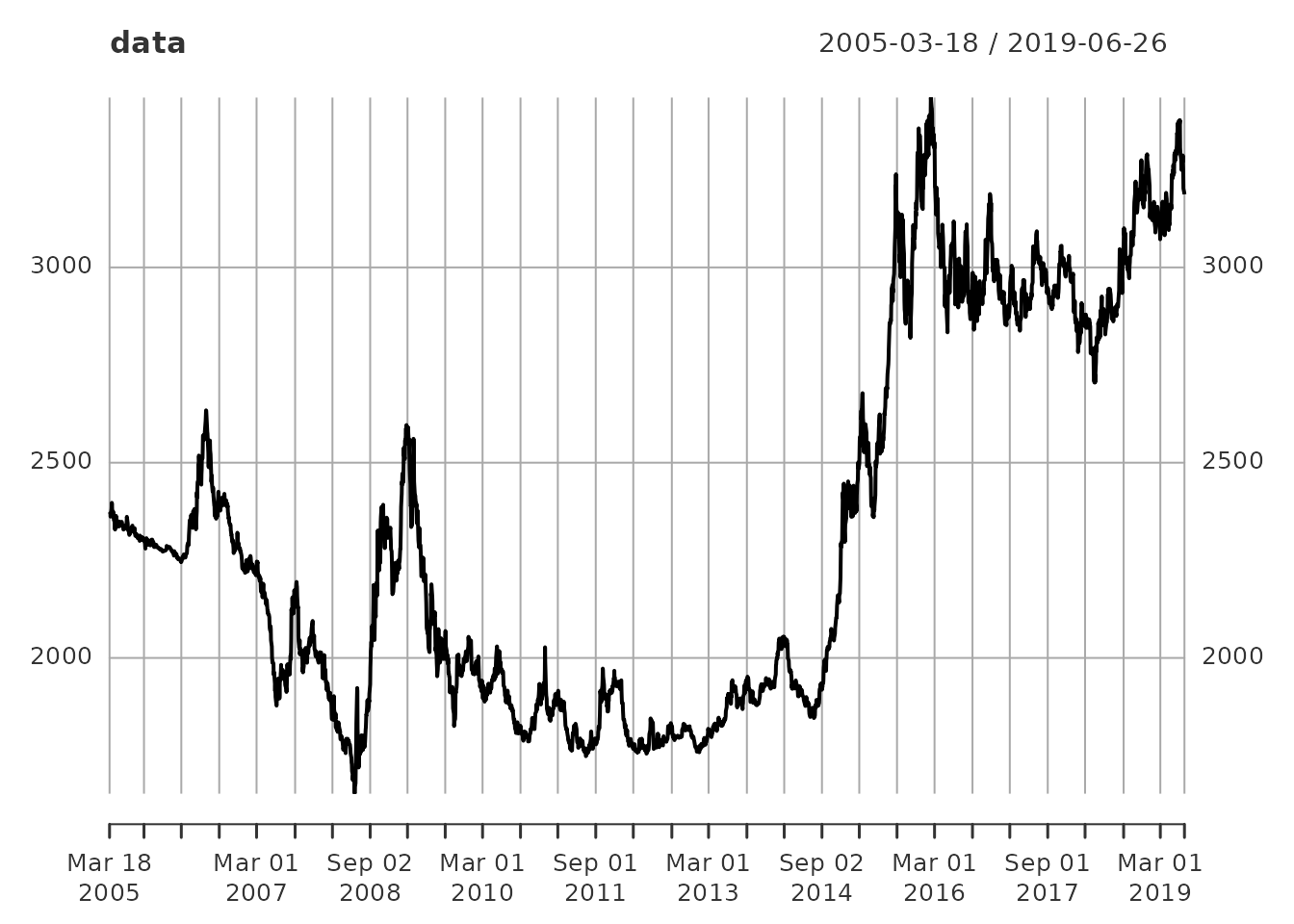

In economic or financial research, it is not necessary to take the

whole time series; use start_date and end_date

under the format “YYYYY-MM_DD” to obtain a specific start and end date.

For example, we want to get the RMRE from March 18, 2005, to June 26,

2019, in an object called data simplifying function

result.

data <- rmre_data(start_date = "2005-03-18", end_date = "2019-06-26")

head(data)

#> rmre

#> 2005-03-18 2374.46

#> 2005-03-22 2371.43

#> 2005-03-23 2361.78

#> 2005-03-28 2382.30

#> 2005-03-29 2397.25

#> 2005-03-30 2393.32

tail(data)

#> rmre

#> 2019-06-18 3286.63

#> 2019-06-19 3264.98

#> 2019-06-20 3248.91

#> 2019-06-21 3202.01

#> 2019-06-25 3191.17

#> 2019-06-26 3187.15

plot(data)

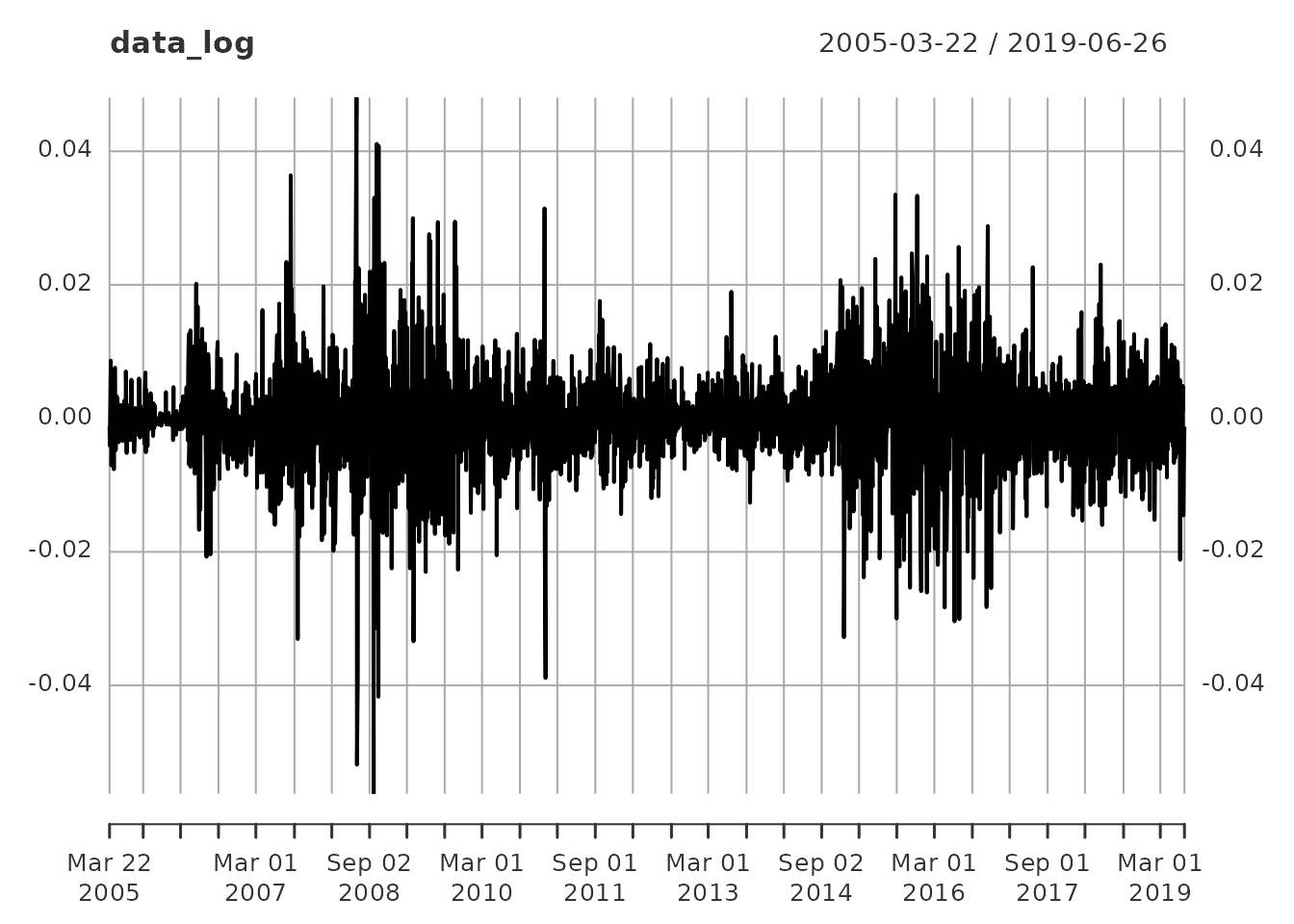

In some research, the historical volatility is expected to be

analysed for advanced econometric or financial studies. It is possible

to use the function log_return=TRUE to change the series to

log return based on the formula: \(lr(RMRE) =

Ln(\frac {RMRE_t}{RMRE_{t-1}})\), in Default the series is

presented in level data.

data_log <- rmre_data(start_date = "2005-03-18", end_date = "2019-06-26", log_return = TRUE)

head(data_log)

#> log_return

#> 2005-03-22 -0.001276894

#> 2005-03-23 -0.004077577

#> 2005-03-28 0.008650836

#> 2005-03-29 0.006255839

#> 2005-03-30 -0.001640724

#> 2005-03-31 -0.007061122

tail(data_log)

#> log_return

#> 2019-06-18 0.004858694

#> 2019-06-19 -0.006609087

#> 2019-06-20 -0.004934082

#> 2019-06-21 -0.014540818

#> 2019-06-25 -0.003391117

#> 2019-06-26 -0.001260520

plot(data_log)

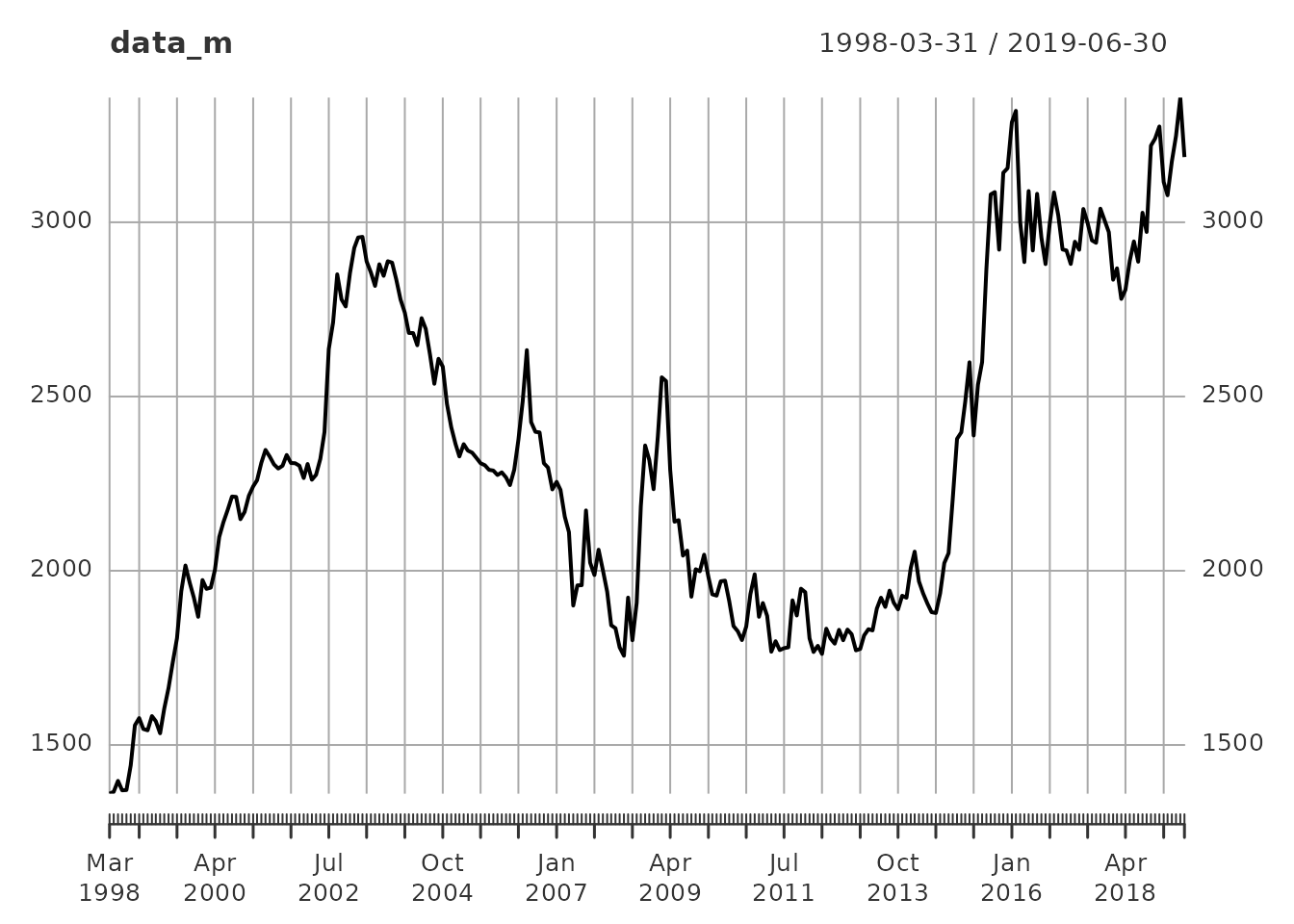

On some occasions, economic or financial variables do not necessarily

use the same time-frequency of the daily series as in the RMRE.

Colombia’s GDP (Gross Domestic Product) is quarterly; therefore, the

RMRE daily series must be transformed into a quarterly one. The

frequency function displays the RMRE series in monthly

(12), quarterly (4) and half-yearly (2) series. By default, the daily

series will be (365). Frequencies can also be transformed to

log_return

The type function can approximate the series on mean or

last date data. When

type = "mean" is used, the series gets the average value of the series in frequency. Iftype

= “last_date” is used, the last data of the series is used in frequency.

By default, the type is set to last_date.

# Monthly RMRE

data_m <- rmre_data(start_date = "1998-03-18", end_date = "2019-06-26", frequency = 12)

head(data_m)

#> rmre

#> 1998-03-31 1360.26

#> 1998-04-30 1365.72

#> 1998-05-31 1397.07

#> 1998-06-30 1369.88

#> 1998-07-31 1370.65

#> 1998-08-31 1441.86

tail(data_m)

#> rmre

#> 2019-01-31 3115.70

#> 2019-02-28 3077.35

#> 2019-03-31 3174.79

#> 2019-04-30 3247.72

#> 2019-05-31 3357.82

#> 2019-06-30 3187.15

plot(data_m)

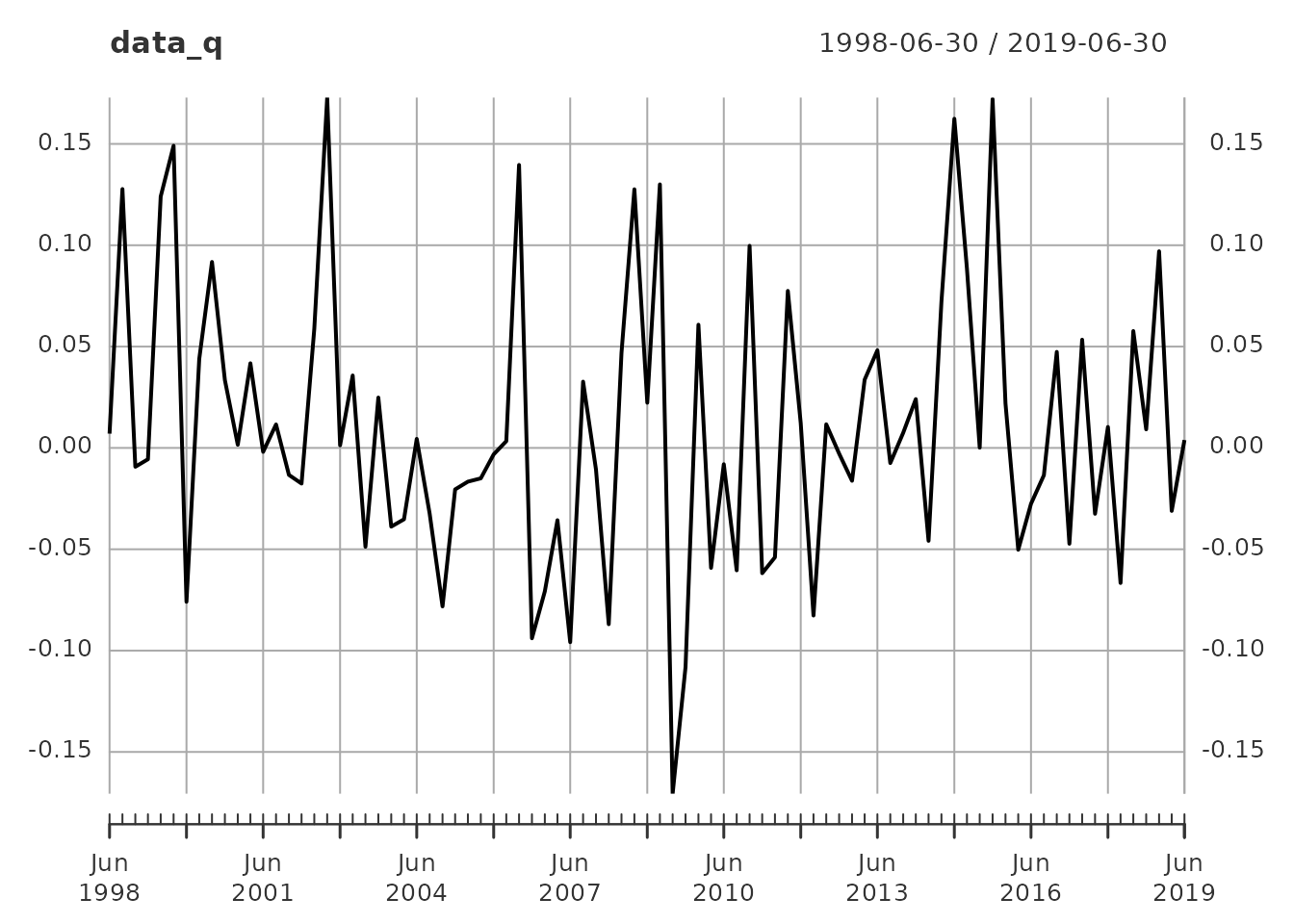

# Quarterly

data_q <- rmre_data(start_date = "1998-03-18", end_date = "2019-06-26", frequency = 4, log_return = T)

head(data_q)

#> log_return

#> 1998-06-30 0.007047287

#> 1998-09-30 0.127729415

#> 1998-12-31 -0.009300952

#> 1999-03-31 -0.005592383

#> 1999-06-30 0.124041672

#> 1999-09-30 0.149092737

tail(data_q)

#> log_return

#> 2018-03-31 -0.066645308

#> 2018-06-30 0.057674061

#> 2018-09-30 0.009156313

#> 2018-12-31 0.097025232

#> 2019-03-31 -0.031079434

#> 2019-06-30 0.003885612

plot(data_q)

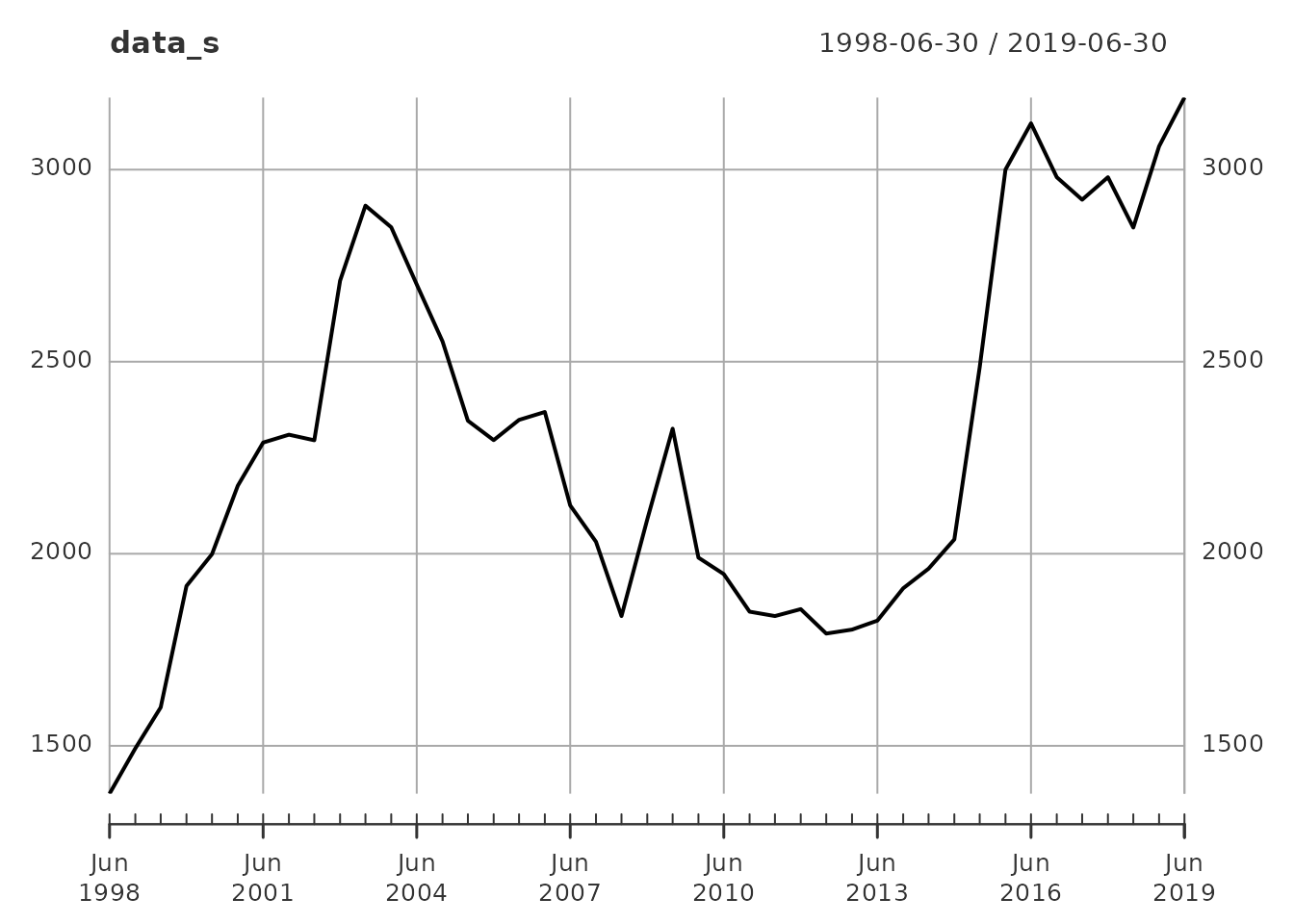

# Half-year

data_s <- rmre_data(start_date = "1998-03-18", end_date = "2019-06-26", frequency = 2, type = "mean")

head(data_s)

#> rmre

#> 1998-06-30 1375.387

#> 1998-12-31 1493.306

#> 1999-06-30 1600.087

#> 1999-12-31 1916.123

#> 2000-06-30 1998.886

#> 2000-12-31 2176.997

tail(data_s)

#> rmre

#> 2016-12-31 2980.250

#> 2017-06-30 2921.711

#> 2017-12-31 2980.267

#> 2018-06-30 2849.155

#> 2018-12-31 3060.683

#> 2019-06-30 3187.564

plot(data_s)

Finally, some researchers feel that displaying a dynamic graph

increases the analysis and learning methods, which is why the

plot_data option can display a Plotly line graph, allowing

the user to analyse the data through the Viewer (See https://plotly.com/r/line-charts/>). This option

works well with the other options of the rmre_data

function.

# Monthly RMRE

rmre_data(start_date = "1998-03-18", end_date = "2019-06-26", frequency = 12, plot_data = T)